Douglas Wilson Companies provides receivership assistance.

A receivership can be a highly-effective remedy for cannabis companies in distress, or for lenders or other stakeholders facing default or other problem scenarios related to cannabis operators, distributors, and retailers — among others.

A court-appointed receiver can work to protect property, collateral and inventory; operate on behalf of the owner; and return value to lenders who have borrowers in default.

Background

From real estate to operating companies, DWC’s team is positioned to support a variety of clients in the cannabis market.

Experience

Douglas Wilson Companies’ team has been appointed in 1,200 receivership matters around North America.

Industry Expertise

DWC has successfully navigated a variety of cannabis scenarios, leveraging industry knowledge and relationships.

Why Choose DWC?

Founded in 1989, Douglas Wilson Companies provides a wide range of specialized business, receivership, and real estate services to financial institutions, law firms, state and federal courts, property owners and similar entities throughout the United States. Douglas Wilson has been a court appointed and independent third party fiduciary for more than 1,200 matters in excess of $15 billion.

Douglas Wilson Companies Vice President Ryan Baker was appointed as receiver to oversee the completion of construction, stabilization of assets and license sale for Aeon Botanika, a high-end cannabis consumption lounge in West Hollywood, California, after Aeon Botanika defaulted on its loan.

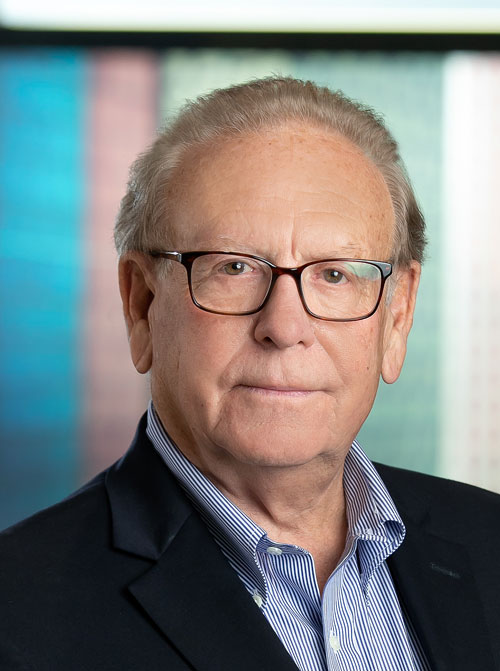

Management Team

The DWC Team supporting your needs.

How can A court-appointed receiver help

Provide protection for assets, operations, and return value.

A receivership can be a highly-effective remedy for cannabis companies in distress, or for lenders or other stakeholders facing default or other problem scenarios related to cannabis operators, distributors, and retailers — among others.

A court-appointed receiver can work to protect property, collateral and inventory; operate on behalf of the owner; and return value to lenders who have borrowers in default.

do you need help from a receiver

A receiver is an effective remedy in a wide variety of cases, including defaults and disputes relating to cannabis operations.

A receiver is typically appointed by a federal or state court to protect assets and stem losses in the case of a borrower in default. You may need a receiver if you are a lender with a borrower in default. You may also need a receiver if you are facing a partnership dispute or another conflict within your business; cannabis operators included.